Explain Difference Between Financial Planning and Financial Forecasting

The forecast is updated at regular intervals perhaps monthly or quarterly. These help predict future trends.

Different Types Of Financial Planning Models And Strategies

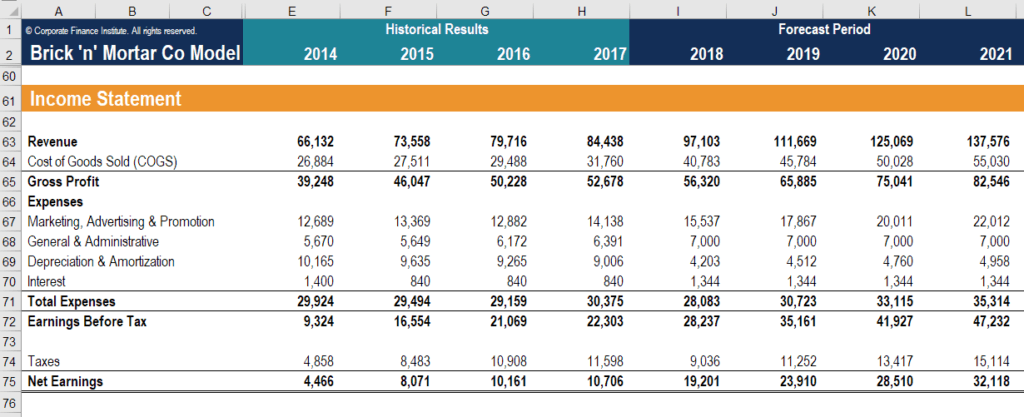

Financial forecasting is often helped by processes of financial modeling.

. Financial modeling is the task of building an abstract representation a model of a financial decision making situation. On the other hand financial modeling entails simulating how financial forecasts and other data may affect the companys future if everything goes according to plan. Thus in a broader sense financial planning can be viewed as the representation of an overall plan for the firms in terms of finance and similarly in a narrower sense it may refer to the process of determining the financial requirements which is needed in order to support a given set of plans in other areas.

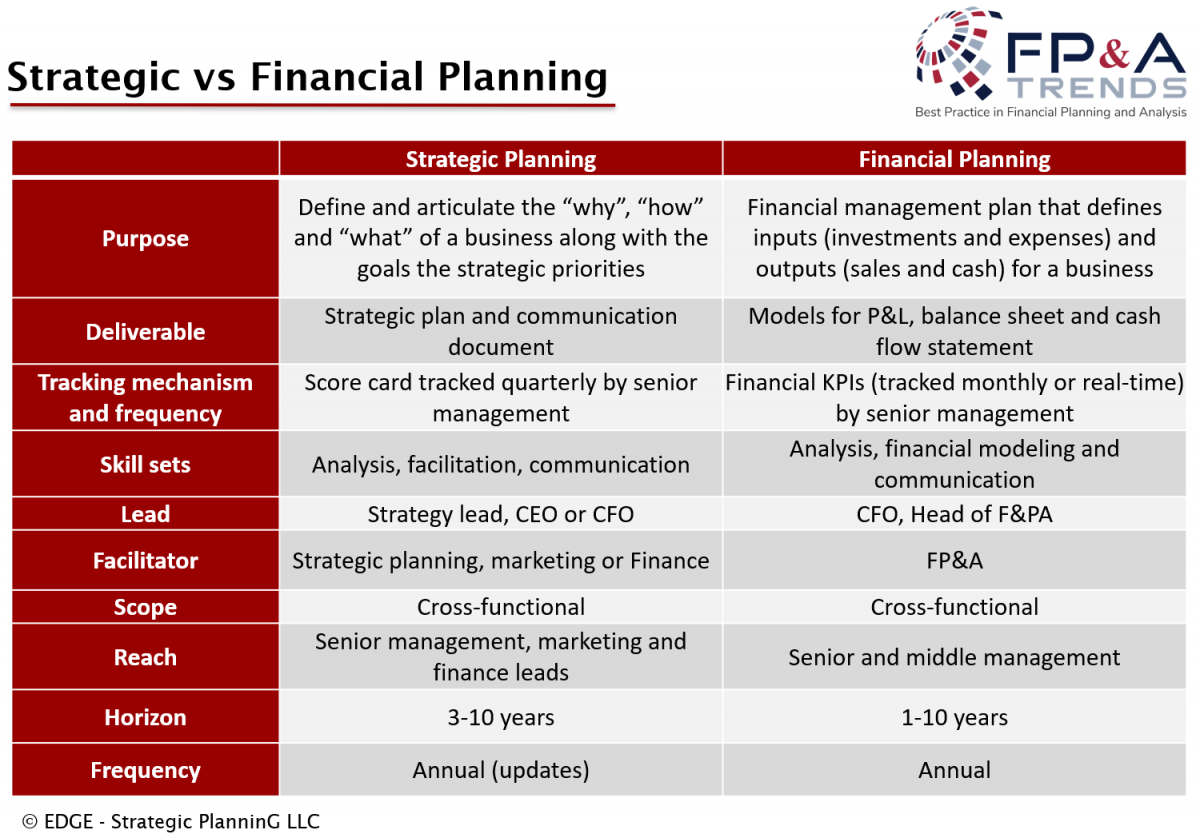

We outline the salary skills personality and. Strategic planning is essentially the why that drives an operation. Planning provides a framework for a business financial objectives typically for the next three to five years.

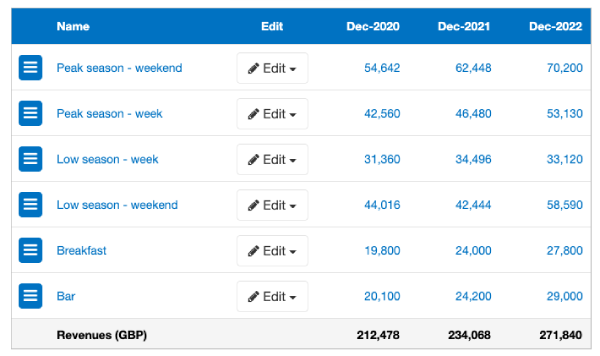

A company estimatespredicts two main things in a. Budget is a financial expression of a business plan whereas forecast is a prediction of upcoming events or trends in business on the basis of present business conditions. March 09 2022 Financial planning and forecasting are integral for a business financial health.

The role of each element of planning budgeting and forecasting is outlined below. While a forecast paints the big picture in terms of what the company wants to achieve and the different factors involved a budget is a step-by-step financial plan showing revenue expectations and expenses over time. A financial forecast is the projection of financial trends and outcomes prepared based on historical data.

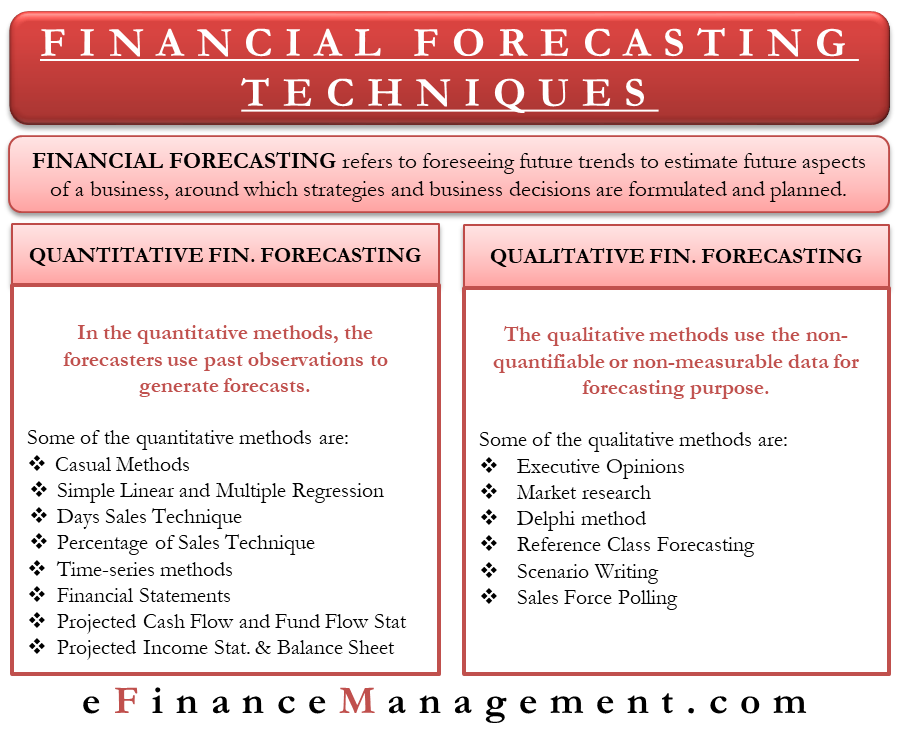

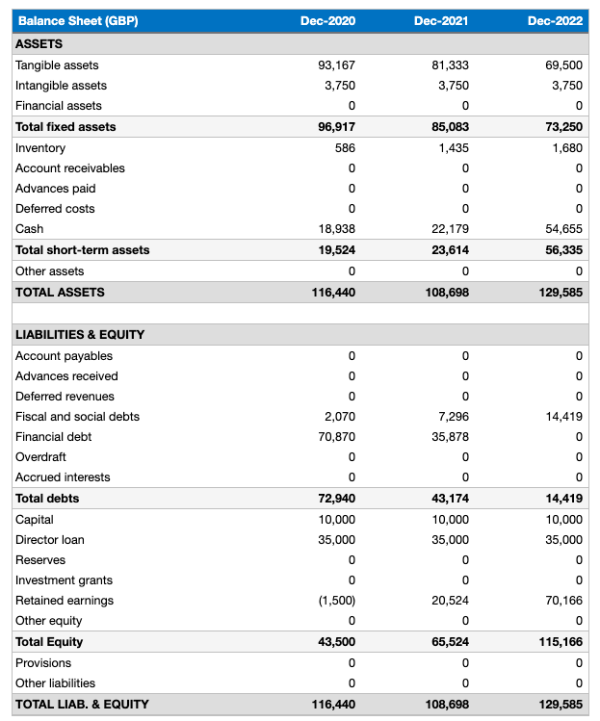

Its more than putting together spreadsheets or crunching numbers. Corporate financial planning and financial analyst professionals utilize both quantitative and qualitative analysis of all operational aspects of a company in order to evaluate the companys progress toward achieving its goals and to map out future goals and plans. Demand planning on the other hand refers to the entire undertaking.

Companies and entrepreneurs use financial forecasting to determine how to spread their resources or what the expected expenditures for a certain period will be. Investors use Financial Forecasting to determine if certain events will affect a companys shares. Once it knows the why it can figure out the how by outlining the requirements to get there including where to place financial resources how to forecast human resource needs and where to place investments otherwise known as financial planning.

Now that we have a better understanding of the two processes we can more easily summarize their differences. You can look at last years payables reports or invoices to examine when customers were supposed to pay and when they actually did. This is a mathematical model designed to represent a simplified version of the performance of a financial asset or portfolio of a business project or any other investment.

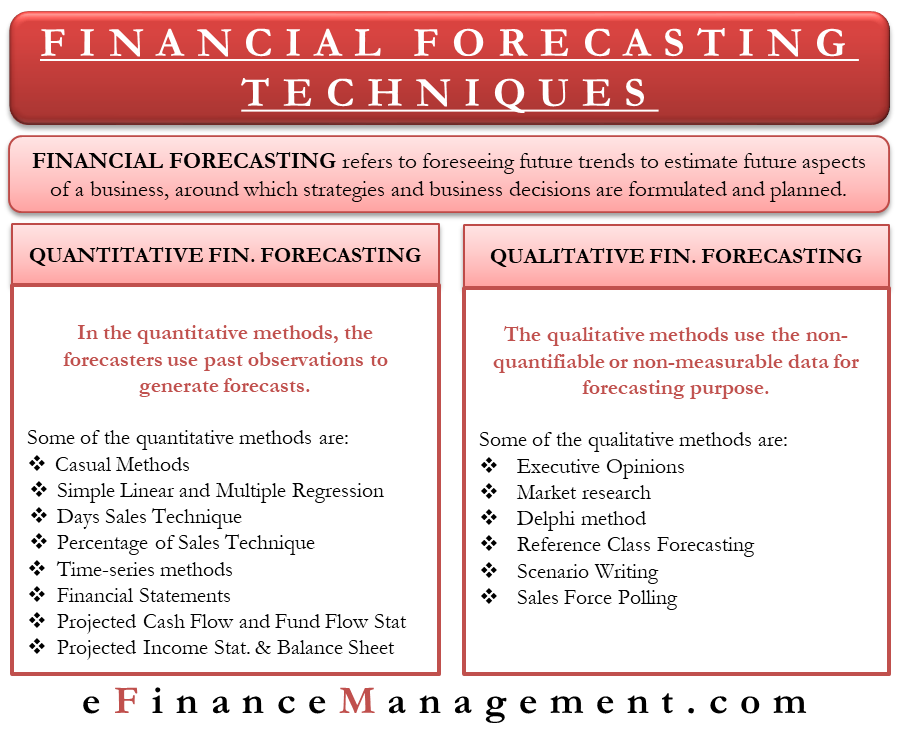

There are five main differences between the two. Quantitative forecasting techniques for projecting cash flow can include looking at last years bank deposits and checks or credit card payments. The forecast is typically limited to major revenue and expense line items.

The difference between budgeting and forecasting comes down to their specific roles in your business. FPA Analysts FPA Analyst Become an FPA Analyst at a corporation. Budgets are prepared annually for every accounting period.

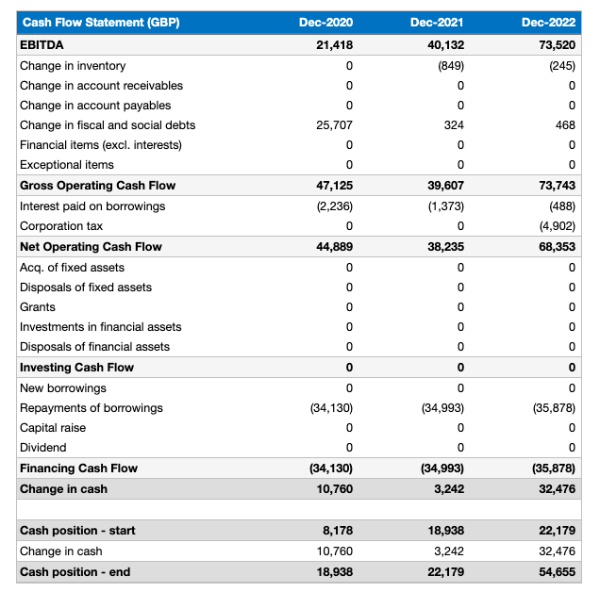

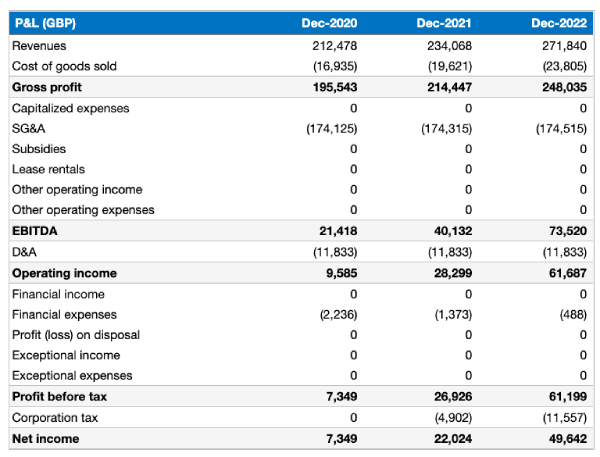

This helps you create a cushion for planning on income. Key Differences Between the Two Financial Processes. Under financial forecasting the forecasters develop future estimates with the help of statements such as the projected income statement projected cash flow statement etc.

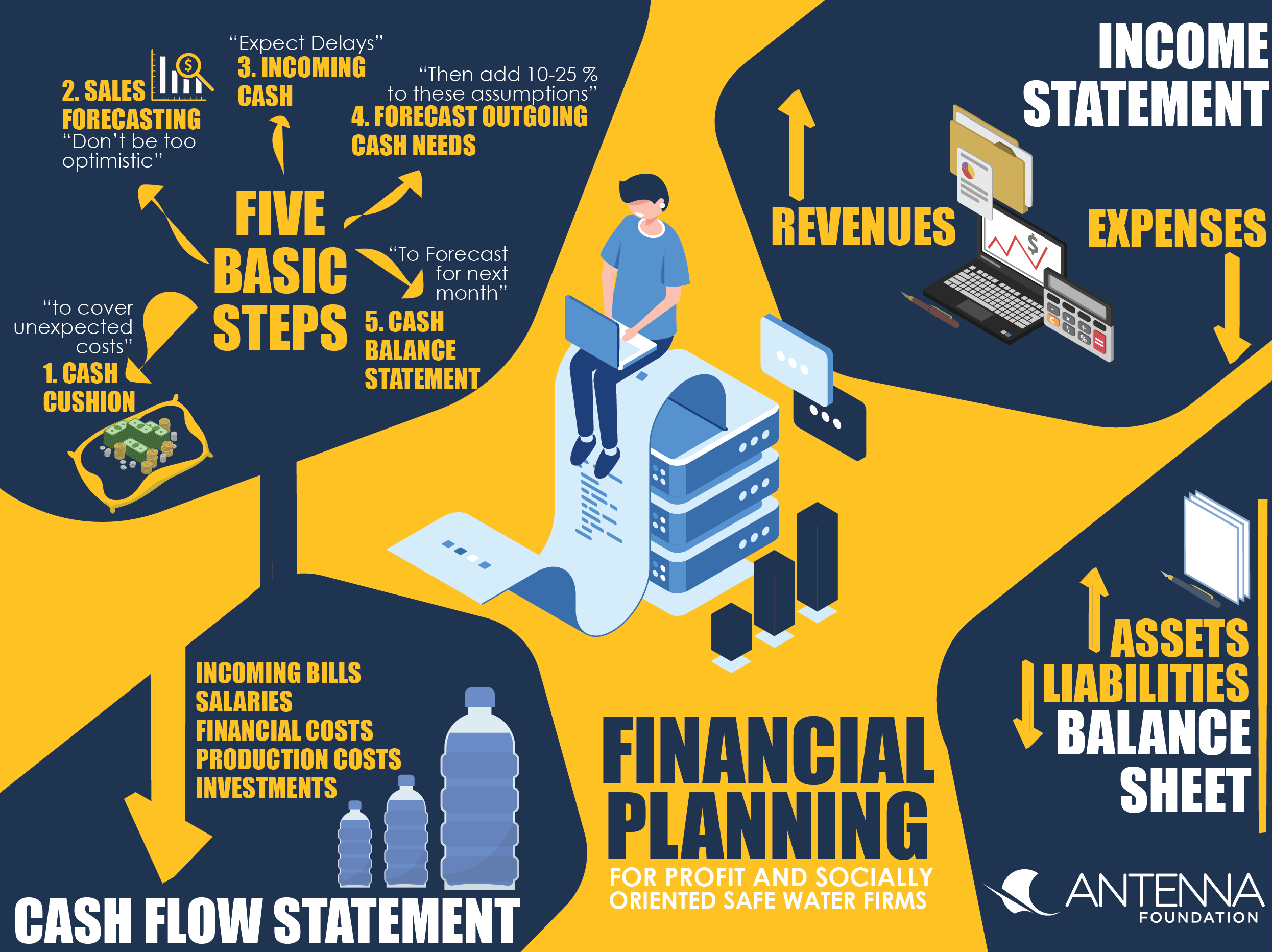

PLANNING A top-down strategic plan that defines the strategic aims of the enterprise and high level activities required to achieve the goals of the organisation BUDGETING A budget that enables resource allocation to be aligned to strategic goals and targets set across the entire organisation. Both financial planning and forecasting are managed on a. Planning budgeting and forecasting are all pieces of the financial management puzzle and together they can help form analyze and evaluate financial performance and suggest solutions to problems.

Financial planning is all about allocating finite resources -- such. In contrast to budgeting financial forecasting does not analyze the variance between forecasts and actual performance. Its overarching goal is to make sure a company can supply customers with a given product or service when where and how they want to buy it while keeping costs as low as possible thus increasing chances of profitability.

It provides information regarding future aspects of a business around which strategies are formulated and planning is done. There is usually no forecast for financial position though cash flows may be forecasted. Reduce your time spent creating budgets and forecasts and get you back to business.

Historical performance data is used to make predictions. Forecasting consumer demand and then arranging things accordingly. Elements of Financial Forecasting.

The forecast is an estimation of future business trends and outcomes based on historical data. A forecast is an estimate of what will actually be achieved. Ad Your planning budgeting and forecasting processes are about to get a whole lot faster.

What is a Forecast. Financial planning and forecasting are interrelated financial practices that help a business determine operations create reasonable expectations and measure actual performance against set goals. What is the difference between financial forecasting and modeling.

Planning budgeting and forecasting is typically a three-step process for determining and mapping out an organizations short- and long-term financial goals. Proper BPF strategy is beneficial to organizations by producing competitive advantages such as more accurate financial reporting and analytics higher overall revenue growth and increased predictive value. On the one hand financial forecasting entails predicting the business future performance.

Financial Forecasting Techniquesi Meaning Methods And Techniques Iefm

Financial Forecast Example For New Businesses And Startups

Financial Forecast Example For New Businesses And Startups

Financial Forecasting Guide Learn To Forecast Revenues Expenses

Preparing Financial Projections And Monitoring Results Alberta Ca

What S The Difference Between A Plan A Budget And A Forecast

Preparing Financial Projections And Monitoring Results Alberta Ca

Fp A Integration Bringing Together Financial And Strategic Planning Fp A Trends

Difference Between Planning And Forecasting Difference Between

Financial Forecast Example For New Businesses And Startups

Financial Planning And Control Definition Importance Process Flow

Financial Planning Analysis Gitlab

/financial_planning_-5bfc2eff46e0fb00511a50ec.jpg)

Financial Plan Vs Financial Forecast

Preparing Financial Projections And Monitoring Results Alberta Ca

Financial Forecast Example For New Businesses And Startups

Financial Planning Sswm Find Tools For Sustainable Sanitation And Water Management

Importance Or Benefits Of Financial Planning

What Is Financial Forecasting Definition Types And More Toolshero

Financial Planning And Analysis Fp A Definition Purpose Importance

Comments

Post a Comment